Falklands Fortune: Rockhopper and Navitas' Sea Lion Play

Introduction

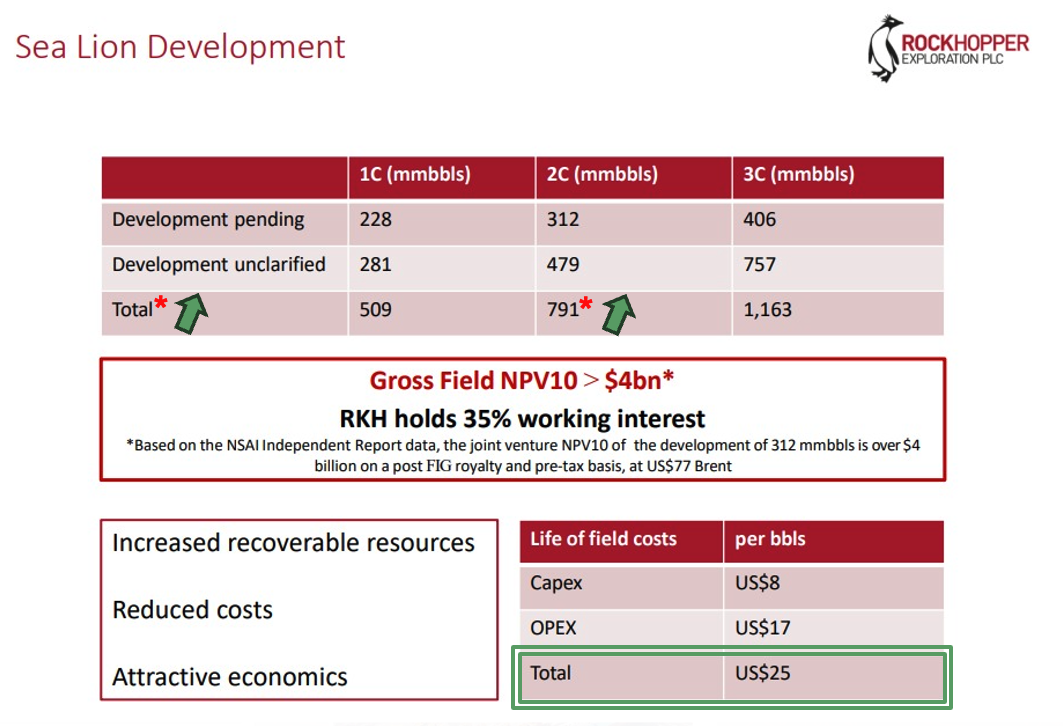

The market rarely offers outstanding investment opportunities, but I want to share one with you today—Rockhopper Explorations (traded in LSE, symbol: RKH). Rockhopper's share in the project is estimated at 441 million barrels of oil and gas in the reservoir Sea-Lion field, partnering with Israeli operator Navitas Petroleum led by Gideon Tadmor. This oil field is close to a final investment decision (FID) in the middle of 2025. Rockhopper's share of the estimated cash flow is at least USD 1.934 billion, accounting for only 62% of the potential reserves of the Sea Lion well (only 62% from the total of 1,259 MMBOE of the Sea-Lion reserves [source]). The Sea-Lion field is in shallow waters in the Falkland Islands, and the total cost of producing a barrel is only $25, allowing a significant margin of safety in a market with a volatile crude oil price. The company has no debt and at least $60 million in cash. Despite these strengths, the company's total value is only $365 million (as of March 2025).

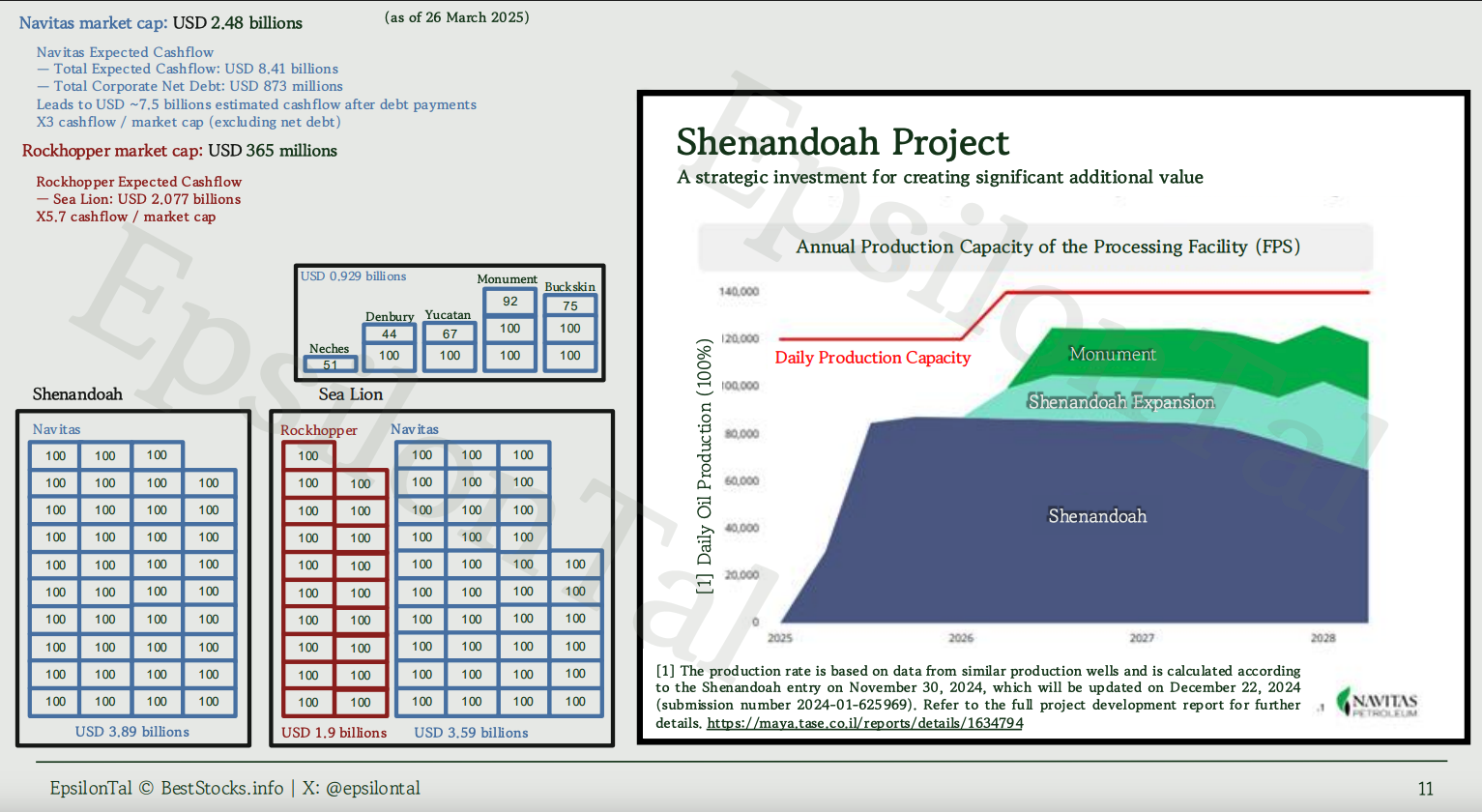

As of now, Navitas has a market capitalization of roughly USD 2,487 million, while Rockhopper's stands at USD 365 million.

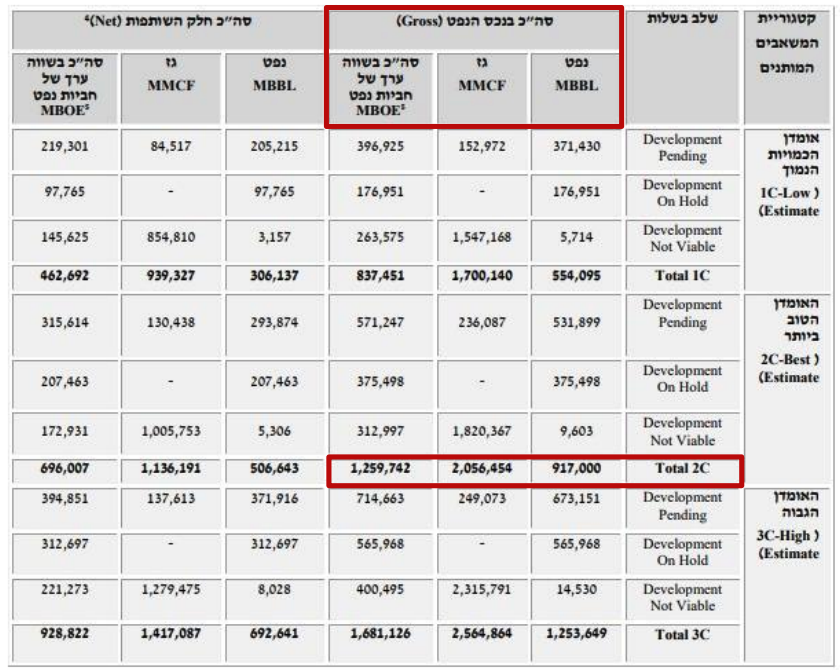

*Navitas's recent report led to an updated reserves report, announcing a proven gas discovery of 2.056 TCF (343 million barrels of oil) and raising total proven resources from 791 million to 1,259 million barrels [source].

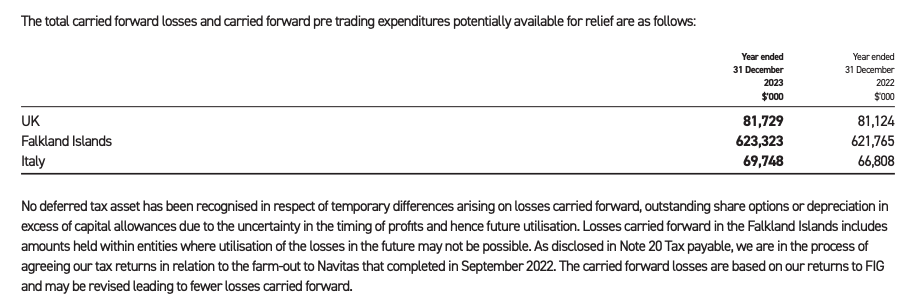

With zero debt and carried forward losses of over USD 600 million accumulated over the years, combined with estimated at 441 million barrels and a total production cost of just $25 per barrel, the estimated potential cash flow promises to reach several billion dollars.

In the following review, we will cover the following topics:

- Introduction

- Background

- About Navitas Petroleum

- About Rockhopper Explorations

- Sea Lion Project (North Falkland Basin)

- Why Rockhopper Offers an Attractive Opportunity for Sea Lion Exposure

- Risks [Level of Impact]

- Disclaimer

- Additional Information

Background

Recently, I started exploring a new direction in the British market, which became a significant holding in my portfolio. Navitas, a company I own shares of, is traded on the Tel Aviv Stock Exchange and is a partner in the Sea-Lion project with Rockhopper Explorations, which trades in the UK. Navitas owns 65% of the project and is the operator, while Rockhopper owns 35%.

The Sea-Lion project is currently in the pre-final investment decision (pre-FID) phase, meaning that key decisions regarding its full-scale development, including funding and construction, have not yet been finalized. This phase is critical for assessing the project's economic and technical feasibility and securing regulatory approvals.

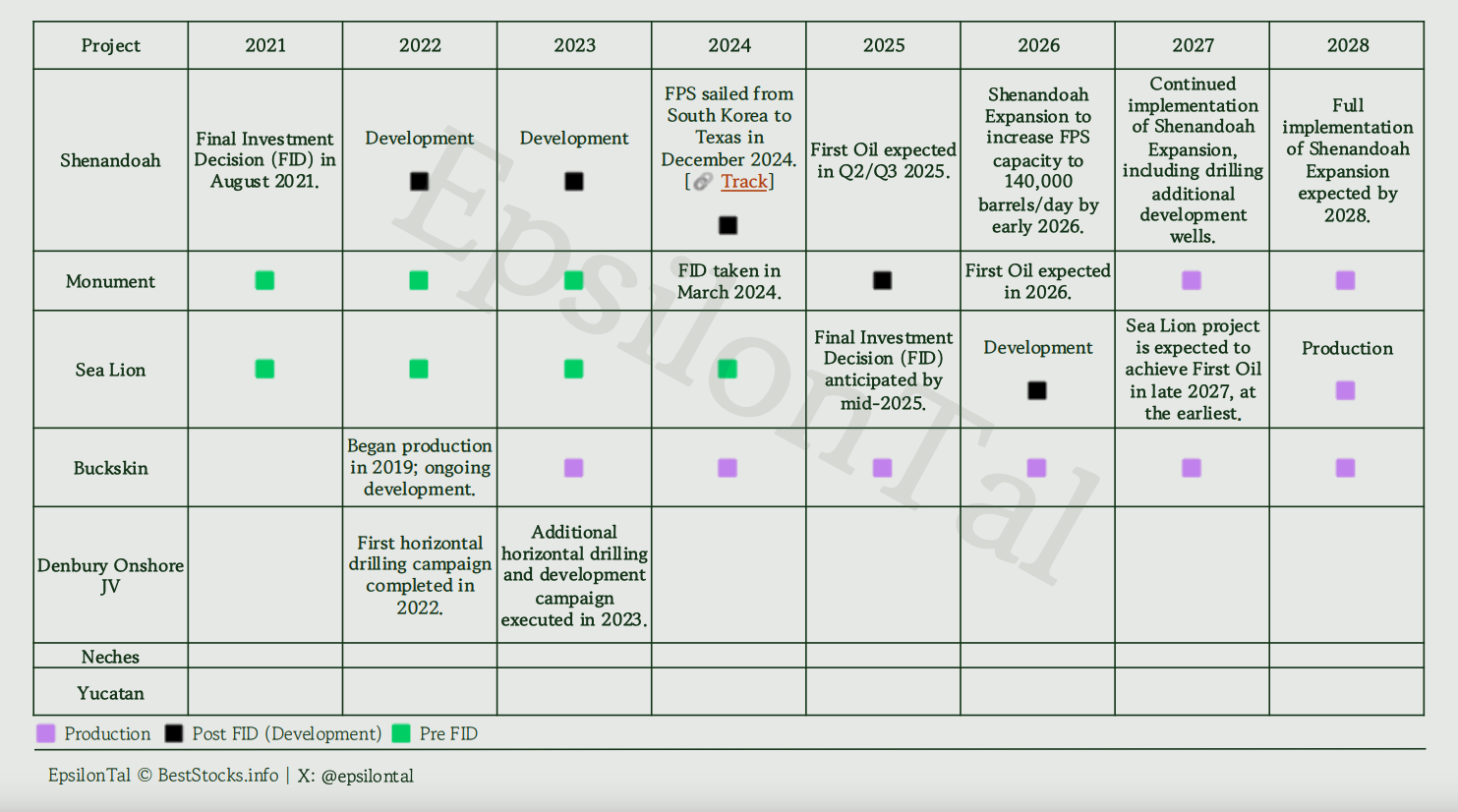

Recently, Navitas confirmed its plans to reach FID by mid-2025. The company updated investors about agreements with suppliers and vendors and progress with regulatory matters in the Falkland Islands.

Drill Check - Well SA008

Positive Indicator: A few days ago, Navitas reported to investors several significant events regarding the Shenandoah project, including:

- Start of production from Shenandoah in June 2025.

- The execution of the flow tests was highly successful, which revealed that it would be possible to produce from the wells at a production rate exceeding that detailed in the reserves report.

- It is worth noting that since President Milly came to power in Argentina, relations with the West have significantly improved. Trade agreements have been signed with the United Kingdom, and Argentina has also withdrawn its threats to take action against entities that work with the Falklands government or operate in the Falkland Islands.

Navitas' progress on the other projects (with an emphasis on Shenandoah) is a positive indication of Navitas' continued ability to finance the development of the Sea Lion project.

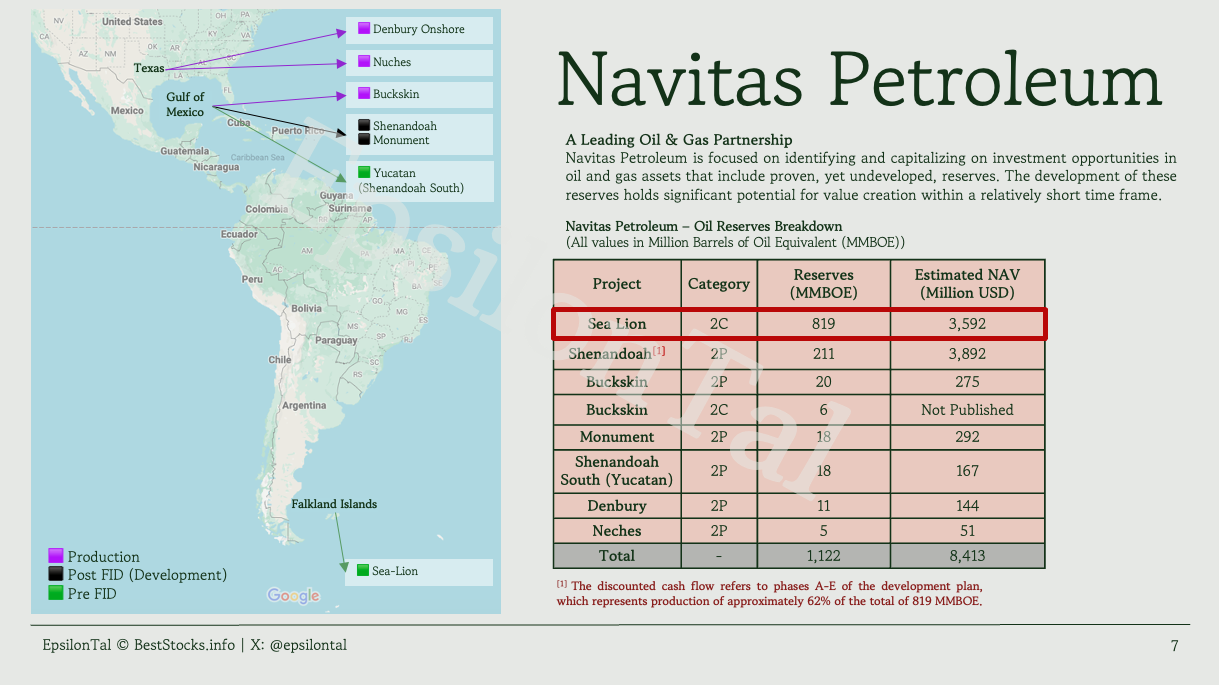

About Navitas Petroleum

Navitas Petroleum is a leading oil and gas exploration and production company focused on identifying, developing, and operating large-scale offshore projects. Known for its technical expertise and financial strength, Navitas has successfully partnered with other industry players to advance complex initiatives in challenging environments. Its portfolio comprises strategically located assets worldwide, including high-potential fields in the United States and the Falkland Islands.

In particular, Navitas is developing major projects such as:

In particular, Navitas is developing major projects such as:

- Shenandoah (Gulf of America) – A significant offshore project currently moving forward, underscoring Navitas’s technical capacity and financial readiness for large-scale developments.

- Buckskin (Gulf of America) – A producing asset that demonstrates Navitas’s expertise in managing operational production and maximizing asset value.

- Monument (Gulf of America) – An exploration opportunity that highlights Navitas’s ongoing focus on high-impact offshore prospects.

By actively progressing new initiatives (like Shenandoah) and partnering on ventures such as Sea Lion, Navitas continues to solidify its position as a leader in offshore oil and gas development.

Management

Mr. Gideon Tadmor, Chairman of Navitas and the living spirit of the partnership, is one of the founding fathers of gas and oil in Israel, a true pioneer. He successfully led six massive projects: Yam Tethys—Noa and Mary, Tamar, Leviathan, Buckskin, Shenandoah, which will begin production this June, and now project number 7—Sea Lion. He led exploration, discoveries, and development, from financing to actual production.

Tadmor is a highly respected figure in Israel and worldwide and is considered a financial wizard. Institutional entities in Israel and worldwide are "standing in line" to give him money for his projects.

Alongside Tadmor, Navits has been managed for years by the experienced and respected CEO, Mr. Amit Kornhauser.

Amit Kornhauser, born in 1976, is a notable Israeli businessman and CEO of Navitas Petroleum. After serving in the Israeli Defense Forces from 1994 to 1998, he earned a Bachelor's degree in Accounting and Economics and an MBA in Finance. Kornhauser began his career at Ernst & Young and held financial positions at Aura Investments and Delek Group. Since joining Navitas Petroleum as CFO in 2016, he raised approximately $2.2 billion, including $1.1 billion for the Shenandoah project. As CEO since January 2022, he has expanded the company's operations in the Gulf of America and the Falkland Islands with the Sea Lion project.

Their project partner is Rockhopper's CEO, Mr. Sam Moody, the Falklands visionary and 2010 Sea-Lion discoverer. He has led Rockhopper since 2004 and has been with it for over 20 years. He is a man with a wealth of experience in oil and gas. Sam previously worked in several roles within the financial sector, including positions at AXA Equity & Law Investment Management and St Paul’s Investment Management.

About Rockhopper Explorations

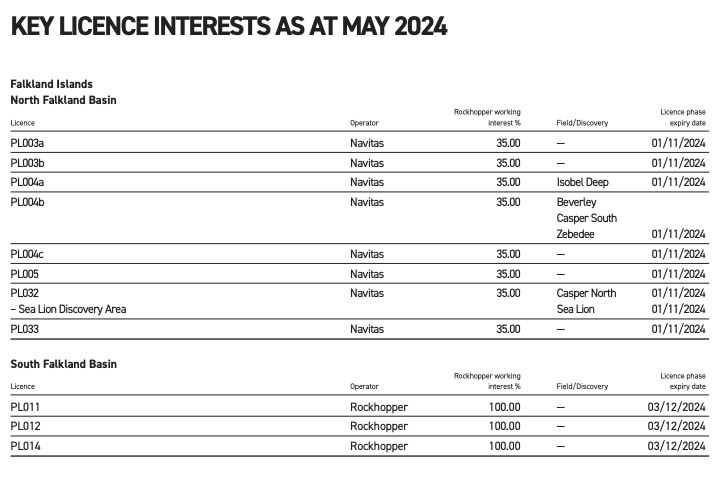

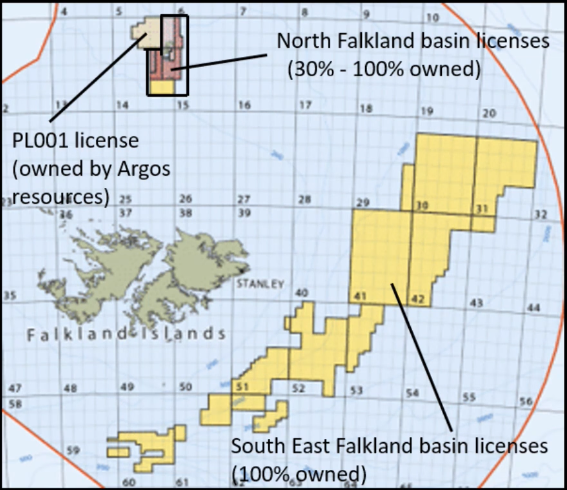

Rockhopper Exploration plc is a UK-based oil and gas exploration and production company focused on the North Falkland Basin. With a 35% stake in the promising Sea Lion project, Rockhopper is positioned to unlock significant offshore resources in partnership with Navitas Petroleum.

Rockhopper holds a 35% working interest in Sea Lion and associated NFB licenses (from Navitas 2024 annual report).

In the conference call on March 24, 2025, Gideon Tadmor described the enormous oil volumes in Sea-Lion and the dramatic increase to the point of doubling the discounted cash flow, and even added: "Not to mention exploration, which is in addition to this (the information presented), and we are not addressing exploration at the moment."

In addition, Rockhopper holds (100% ownership) 3 oil licenses in the South Falklands.

The company combines strategic asset development with a commitment to operational efficiency, targeting long-term growth in the energy sector.

Outlook

Navitas' latest resource report on the Sea Lion project, dated November 25, 2024, provided new information about a significant gas discovery of 2.056 TCF (equivalent to 343 million barrels of oil).

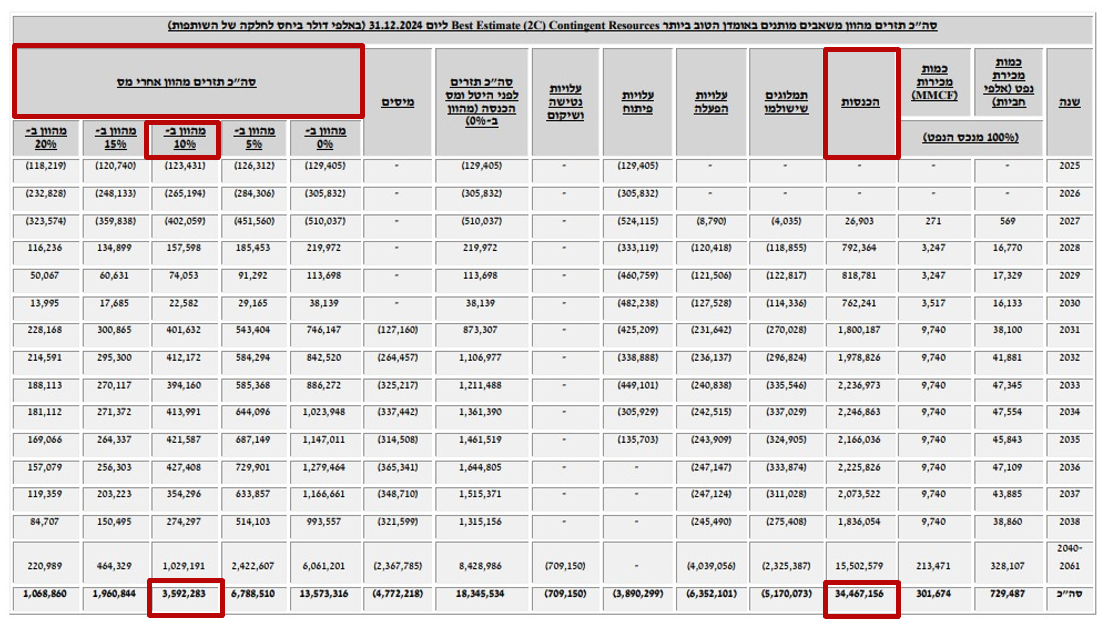

SourceIn addition, data published in recent days shows that Navitas' discounted cash flow in Sea-Lion has doubled to $3.592 billion (for only 62% from the total of 1,259 MMBOE of the Sea-Lion reserves [source]). Rockhopper's share of the cash flow is $1.934 billion.

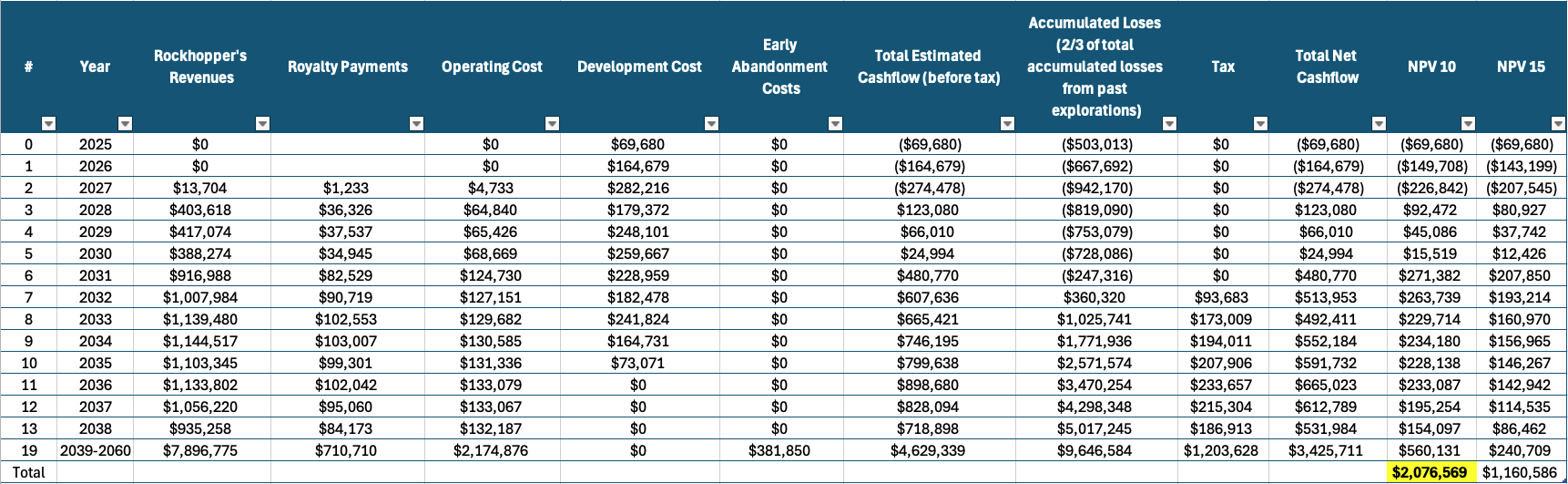

Attached is an image of a discounted cash flow table from Navitas' 2024 annual report.

* Refers to Navitas' share only in the Sea-Lion and only 62% of the oil asset (for only 62% from the total of 1,259 MMBOE of the Sea-Lion reserves [source]).

Below is a model, showing Rockhopper's projected cash flow from the Sea Lion project (for only 62% from the total of 1,259 MMBOE of the Sea-Lion reserves [source]).

The model is based on a crude oil price of USD 70.

As detailed in the cash flow document, Rockhopper’s stake (representing only 62% from the total of 1,1259 MMBOE of the Sea-Lion reserves [source]) is valued at $2.076 billion based on a barrel price of $70. In contrast, the market value is approximately $365 million, resulting in a ratio of over 5.5 between the market value and the diversified cash flow at a 10% discount rate (NVP=10).

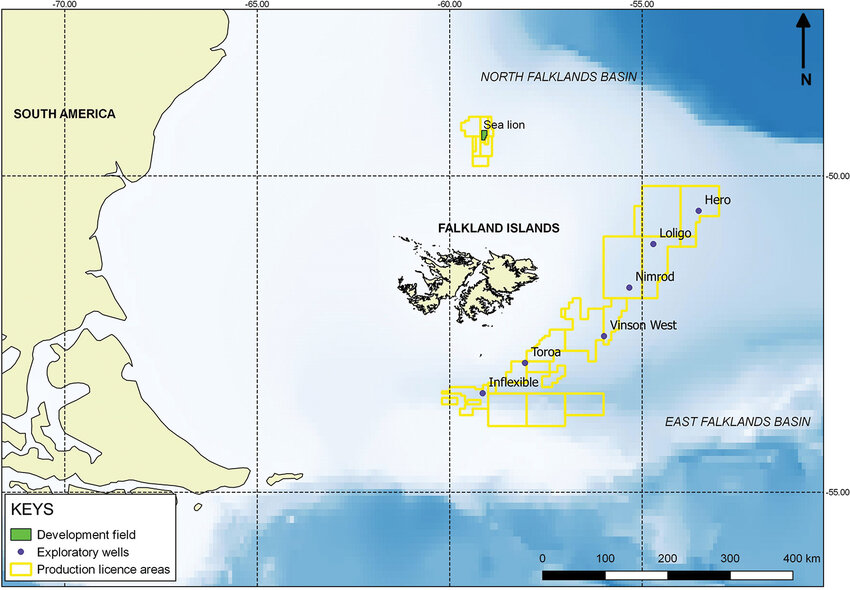

Sea Lion Project (North Falkland Basin)

The Sea Lion project operated by Navitas involves shallow waters with minimal pressure, making the extraction process relatively simple and straightforward.

Partnering with Rockhopper Exploration, Navitas holds a 65% stake and operates the Sea Lion project, which has 917 million barrels and 2.056 TCF (equivalent to 343 million oil barrels), totaling 1.259 billion oil barrels [source]. In the pre-final Investment Decision (pre-FID) phase, the project represents a significant long-term opportunity for both companies.

Why Rockhopper Offers an Attractive Opportunity for Sea Lion Exposure

Rockhopper’s interest in the Sea Lion oil field provides a compelling investment case due to its relatively modest market capitalization and the substantial cash flow expected from the project. Below is a concise breakdown of the key points:

Project Financing by Navitas

Navitas covers Rockhopper’s share of the Sea Lion project costs without charging interest or indexation. This means Rockhopper will only repay Navitas from future cash flow once Sea Lion begins production, which is anticipated at the end of 2027.

Significant Accumulated Losses

As of 31 December 2023, Rockhopper reports total carried forward losses of USD 81.7 million in the UK, USD 623.3 million in the Falkland Islands, and USD 69.1 million in Italy; no deferred tax asset is recognized against these losses due to uncertainty about future profits and utilization; the farm-out to Navitas completed in September 2022 is under tax review and may reduce the total carried forward losses; certain jurisdictions (e.g., the Falkland Islands) may impose further limitations on using these losses if profits do not materialize; and ongoing assessments of these unrecognized losses will continue as exploration, development, and production activities progress.

No Third Party Royalty Payment

Unlike Navitas, Rockhopper is not required to pay an overriding royalty to a third party. This helps preserve a larger share of the project’s revenues and can positively impact Rockhopper’s profitability once Sea Lion begins generating income.High Cash Flow Potential Relative to Market Cap

Rockhopper's market capitalization is about USD 313 million, but its share of the Sea Lion project will generate an estimated USD 1.9 billion in cash flow. This implies a projected cash-flow-to-market-cap ratio of roughly 5.1—meaning the potential cash flow could be more than 6 times the company’s current value.

Comparison to a Larger Peer

In contrast, Navitas Petroleum, a much larger partner and stakeholder in various projects, has a market cap of USD 2.43 billion and expects to generate approximately USD 8.41 billion in cash flow. After subtracting around USD 873 million in net debt, Navitas’s estimated cash flow stands at about USD 7.5 billion. This yields a cash-flow-to-market-cap ratio of around 2.9, which, while still significant, is notably lower than Rockhopper’s multiple.

Undervalued Entry Point for Sea Lion

Because Rockhopper is smaller, its share of Sea Lion's revenues has a disproportionately positive impact. Investors seeking direct exposure to Sea Lion’s upside may find Rockhopper particularly appealing, as the project’s success could outsize Rockhopper’s valuation.

Strong Production Profile

Based on data from similar wells, Sea Lion is projected to add material oil production once it comes online, enhancing Rockhopper’s overall production and revenue. This will drive top-line growth and shareholder returns over the coming years.

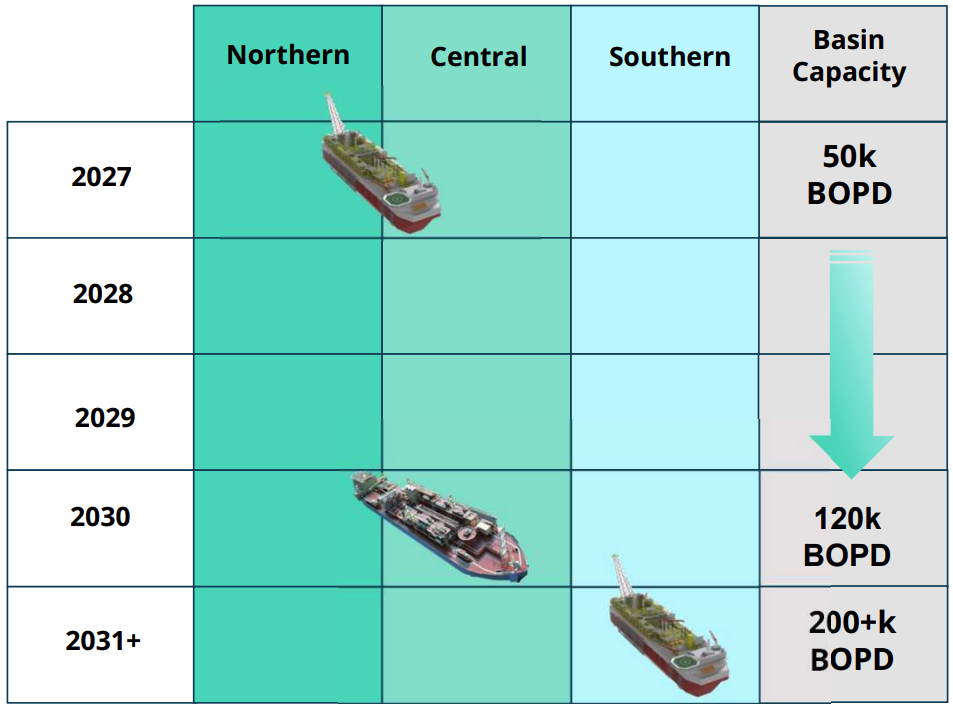

Phased Development with 200,000 Barrels per Day Production Potential

With the start of production in Sea-Lion, the daily production rate will be approximately 50,000 barrels per day. This rate is expected to steadily increase and exceed 200,000 barrels per day, as detailed in the attached slide.

Ensuring Responsible Fund Allocation

Under its agreement with Navitas, Rockhopper must use the initial project revenues exclusively to repay Navitas’s financing. By preventing Rockhopper from channeling those funds into new, potentially speculative ventures before fulfilling its obligations, this provision effectively safeguards investors. It ensures that available cash flows will be used responsibly—focusing on debt repayment—before the company embarks on any further projects.

Additional Licenses in The Falkland Islands

On the sidelines, but not on the sidelines of their importance, it should be emphasized that in addition to all of the above - Rockhopper holds (100% in one hand) 3 oil licenses in the Falklands.

Furthermore, it holds oil discoveries near Sea Lion that have a good chance of being developed when Sea Lion becomes a regional HUB.

Rockhopper’s relatively low market cap and high potential cash flows from the Sea Lion project create a unique opportunity for investors who want targeted exposure to a significant offshore development. The discrepancy between its modest valuation and the scale of the future cash flows highlights the potential upside should Sea Lion proceed as planned.

Risks [Level of Impact]

[High] Fall of Sea-Lion deal.

— The Sea Lion project is a cornerstone of both Navitas' and Rockhopper's strategic plans. A complete failure of the deal would mean losing access to a significant resource base, particularly the 917 million barrels and 2.056 TCF (equivalent to 343 million oil barrels) of recoverable resources.

— For Rockhopper, the loss of this partnership would have catastrophic financial implications, given their reliance on Navitas' technical expertise and financial capacity to progress the project. This could destabilize the company's entire business model, given its limited resources.

— For Navitas, while it has other projects in its portfolio, the reputational damage and loss of strategic positioning in the North Falkland Basin could deter future collaborations and opportunities. Moreover, the substantial investments made during the pre-FID phase would become sunk costs.

— The project is in a geopolitically sensitive area, and any political, regulatory, or financial barriers that lead to a deal's collapse would significantly harm shareholder value for both companies. It is worth noting that since President Milly came to power in Argentina, relations with the West have significantly improved. Trade agreements have been signed with the United Kingdom, and Argentina has also withdrawn its threats to take action against entities that work with the Falklands government or operate in the Falkland Islands.

[Low] Delays in Sea-Lion FID.

— While delays in the Final Investment Decision (FID) phase could push back the project's timeline, they are not unusual in large-scale offshore oil projects. Such delays are often factored into long-term strategic planning.

— Navitas has demonstrated the financial resilience and technical capacity to handle such delays, as evidenced by their progress in other complex projects like Shenandoah. Their strong relationships with Israeli financial institutions provide a cushion to navigate funding challenges.

— For Rockhopper, although delays could strain their financial position, they have shown the ability to secure partnerships and capital when necessary, particularly given the project's high potential.

— Delays may also provide an opportunity to refine the technical and economic feasibility of the project, potentially reducing risks during the development phase.

— The Falkland Islands government and other stakeholders are incentivized to support the project due to its potential economic benefits, which reduces the likelihood of delays escalating into a critical risk.

[Low] Rockhopper Struggles in recruiting equity pre-FID

(estimated between USD 70-75 million).

— It is possible to raise capital to pass this risk.

— Reminder: As of today, Rockhopper has an estimated cash balance of about $28 million. In addition, Rockhopper is guaranteed at least $31 million in the lawsuit against the Italian government. Totaling of about $60 million.

[Low] Navitas Struggles in recruiting equity for FID.

— Navitas holds strong reputation and relationship with the Israeli banks and institutions.

Disclaimer

Disclaimer: The writer owns shares in Rockhopper Exploration and in Navitas Petroleum. This is not a recommendation, no guarantee for any outcomes. The share price can go up or down depending on the development of the Sea-Lion project, which is highly volatile. Oil exploration and operations are considered high-risk investments, and careful consideration is advised.

Additional Information

Navitas: Additional Projects

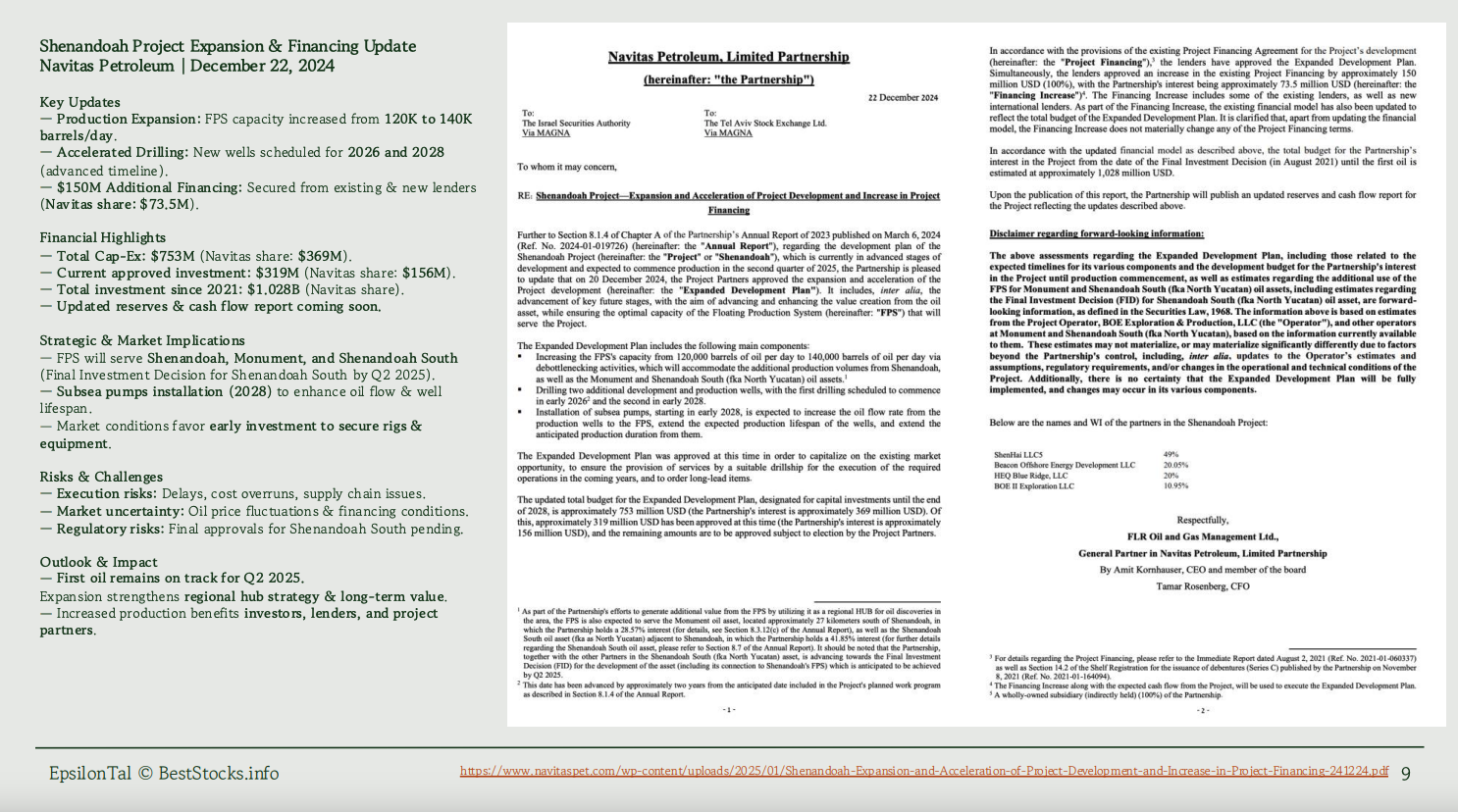

Shenandoah Project (Gulf of America):

Navitas is moving forward with this significant offshore project, highlighting the company's ability to execute and develop large-scale operations. Shenandoah's progression demonstrates Navitas' technical capacity and financial readiness to handle challenging offshore developments.

Buckskin Project (Gulf of America):

A producing asset in Navitas’ portfolio, Buckskin underscores the company's expertise in managing operational production and its commitment to maximizing asset value.Monument Project (Gulf of America):

This project represents another exploration opportunity in Navitas' portfolio. Located in the Gulf of America, Monument has the potential for significant resource development. It reflects Navitas' continued focus on high-impact offshore exploration, complementing its more developed projects like Shenandoah and Buckskin.By advancing projects like Shenandoah and Monument and collaborating on opportunities like the Sea Lion project, Navitas continues to solidify its position as a leader in offshore oil and gas development.

Rockhopper's Timeline

- 2020

- Heads of Terms Agreement with Navitas (January 7): Rockhopper and Navitas signed detailed heads of terms, formalizing their intention to collaborate on the Sea Lion project. The initial target for finalizing definitive documentation was set for March 31, 2022. ROCKHOPPER

- 2021

- Ombrina Mare Arbitration Update (December 21): Rockhopper provided an update on its international arbitration against the Republic of Italy concerning the Ombrina Mare field. ROCKHOPPER

- 2022

- 7m Capital Raise

- Initial Deadline (March 31): The initial deadline for finalizing the definitive documentation. This deadline was later extended.

- Navitas sign technical agreement (April 19): Rockhopper and Navitas signed the definitive documentation for the agreement.

- Transaction Completed (September 23): The transaction between Rockhopper and Navitas was completed, marking the official start of their partnership on the Sea Lion project.

- 2023

- Ombrina Mare Arbitration Award (December 20): Rockhopper announced the monetization of its Ombrina Mare Arbitration Award, with plans to receive payments in tranches.

- 2024

- Receipt of Tranche 1 Funds (June 21): Rockhopper received €19 million of the €45 million Tranche 1 payment from the Ombrina Mare Arbitration Award. Rockhopper Exploration

- Sea Lion Operator's Update (November 25): Navitas Petroleum, the operator of the Sea Lion project, provided an update on development progress, including an updated independent resource report. Rockhopper Exploration

- 2025

- Final Investment Decision (FID) Target: Navitas Petroleum has indicated that the FID for the Sea Lion project is now expected by mid-2025, with first oil anticipated by late 2027. Wikipedia

- 2027

- FID Deadline (September 23): This is the critical deadline by which the Final Investment Decision (FID) must occur. If the FID has not been made by this date, Rockhopper has the option to remove Navitas from the Falkland Islands petroleum licenses by repaying the Pre-FID Loan.

- First Oil (Expected Late 2027): Navitas Petroleum, the operator of the Sea Lion project, has indicated that first oil is anticipated by the end of 2027, assuming the Final Investment Decision (FID) is made in mid-2025. This timeline depends on the successful completion of development and construction phases following the FID.