EL-AL Conference Call Summary

Disclosure - The information provided should not be considered a recommendation or a substitute for personalized investment advice or marketing. The author is not an advisor and does not hold a license. The content is written from a personal perspective. It serves as a private review and analysis shared with the general public based on information gathered from various sources, which may contain inaccuracies. There may be errors and changes. There is no guarantee that this information will generate profits, and it should be assumed that the review's author is interested in the subject matter. Furthermore, it should be assumed that the review's author has an interest in or holdings related to any of the companies mentioned.

HOLDING, NOT A RECOMMENDATION.

ASK Growth and Market Demand

The increase in ASK (Available Seat Kilometers) significantly contributed to financial results. The occupancy rate is the key story of the year—a 94% load factor reinforces the point I've emphasized before: occupancy rates have a more significant impact than ticket prices.

I've also mentioned that EL-AL can remain competitive even as foreign airlines return to Israel, thanks to its cash surplus exceeding its debt.

Q4 2024 Performance and Industry Trends

— Maintaining high EBITDAR and reporting a net profit of $130M in Q4.

— ASK growth is driven by fleet reactivation.

— Q4 occupancy reached 96%, an exceptionally high number by global standards.

— EL-AL is thriving while traffic at Ben Gurion Airport has declined significantly.

— Global demand for flights remains exceptionally strong—this is a worldwide trend, not just in Israel.

— ASK growth is driven by fleet reactivation.

— Q4 occupancy reached 96%, an exceptionally high number by global standards.

— EL-AL is thriving while traffic at Ben Gurion Airport has declined significantly.

— Global demand for flights remains exceptionally strong—this is a worldwide trend, not just in Israel.

Revenue and Forward Bookings

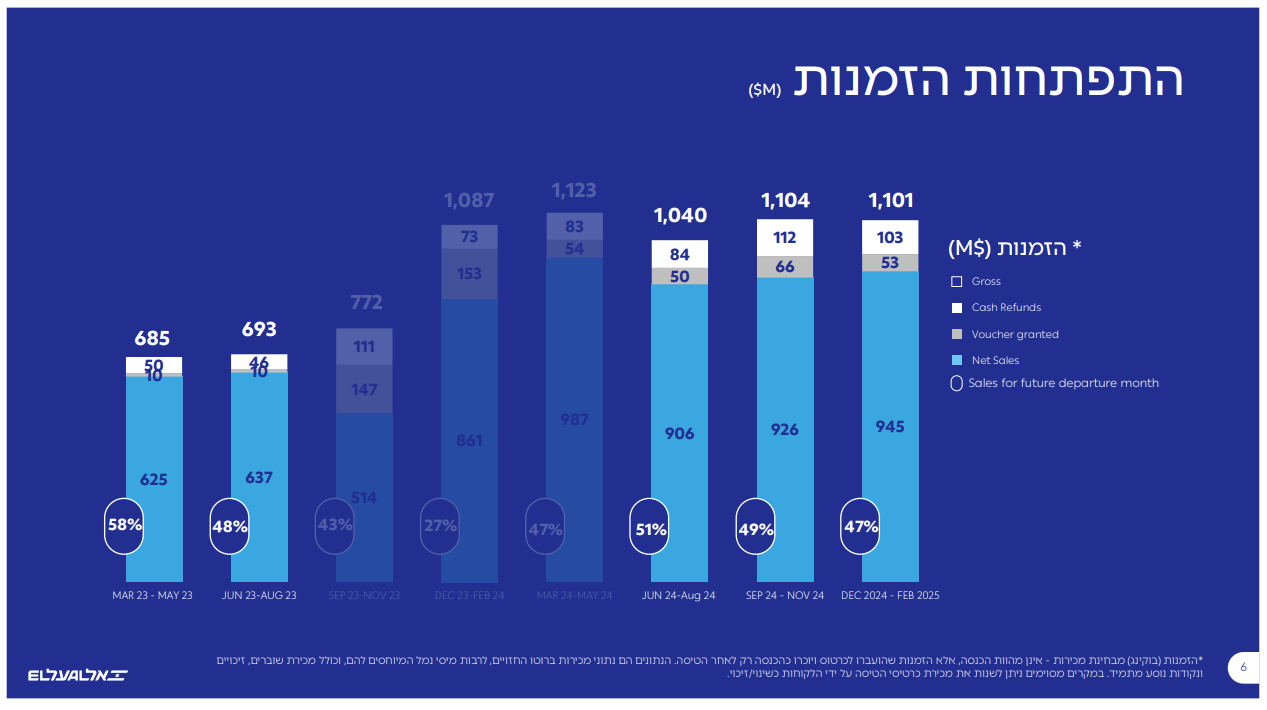

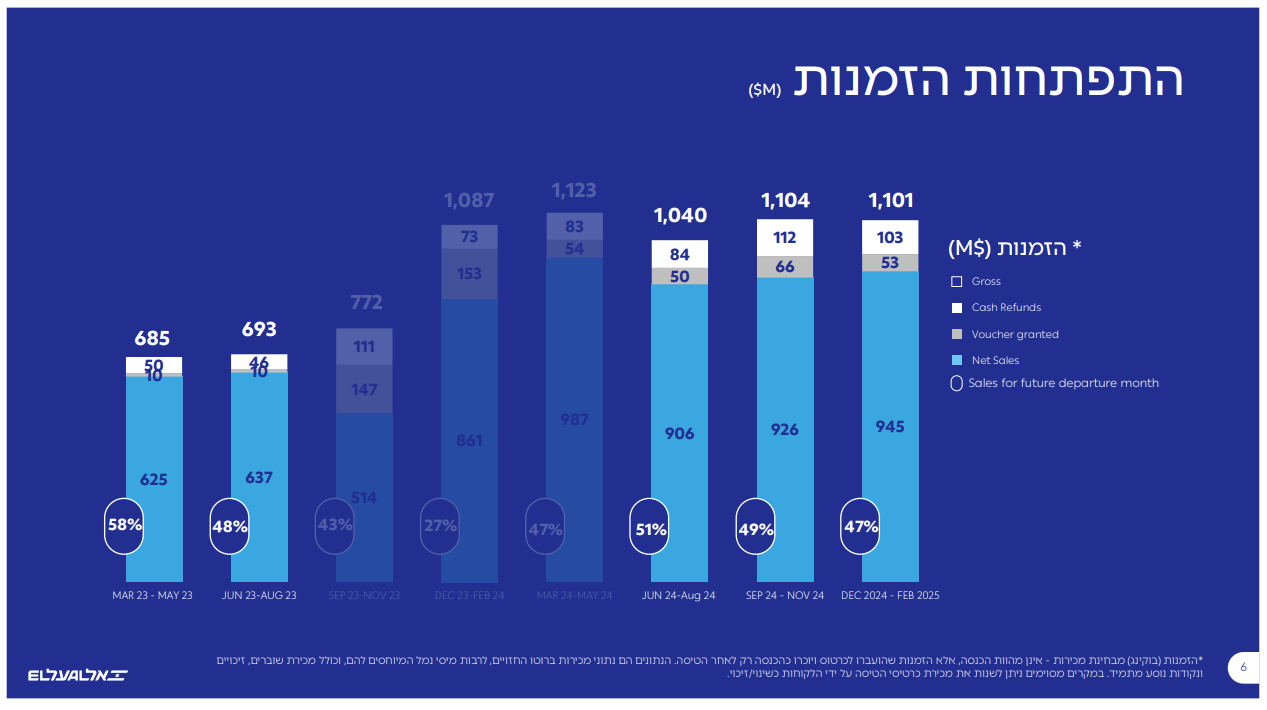

— Since mid-2024, sales have stabilized above $1B per period.

— December 2024 - February 2025 bookings exceed $1.1B, with a continued strong outlook for Passover 2025.

— More available seats mean higher forward revenue projections.

— December 2024 - February 2025 bookings exceed $1.1B, with a continued strong outlook for Passover 2025.

— More available seats mean higher forward revenue projections.

Foreign Airlines’ Return and Market Adjustments

— Foreign carriers are gradually returning to Ben Gurion Airport.

— Capacity is expected to increase in 2025 compared to 2024 but will still be lower than pre-war levels.

— EL-AL expanded capacity between October 2022 and October 2023 by reactivating aircraft and optimizing its network.

— A gradual return of foreign airlines by July 2025 is anticipated.

— Foreign airlines’ return helps EL-AL by reducing pressure on operations and improving customer service.

— Capacity is expected to increase in 2025 compared to 2024 but will still be lower than pre-war levels.

— EL-AL expanded capacity between October 2022 and October 2023 by reactivating aircraft and optimizing its network.

— A gradual return of foreign airlines by July 2025 is anticipated.

— Foreign airlines’ return helps EL-AL by reducing pressure on operations and improving customer service.

Key Growth Drivers in 2024

— Increased capacity (reactivated aircraft and fleet expansion).

— High occupancy rates (flights departing at full capacity).

— Strategic pricing management with fixed low-fare routes to meet demand.

— Controlled maximum fares in economy class.

— Support for security forces, hostages’ families, and reservists.

— Strategic pricing management with fixed low-fare routes to meet demand.

— Controlled maximum fares in economy class.

— Support for security forces, hostages’ families, and reservists.

Shifting Consumer Preferences

— Customers prioritize security and are willing to pay for add-ons like PROTECT and flexible tickets.

— Revenue is driven primarily by ASK growth, high load factor, and cargo.

— Revenue is driven primarily by ASK growth, high load factor, and cargo.

Key Strategic Goals

— ASK growth of 26%, increasing from 28 in 2024 to 35 by 2030.

— Revenue growth of over 20% to over $4B by 2030.

— EBITDAR margin target of 17-21%.

— Net debt-to-EBITDA ratio target of lower than 3.

— Cash balance to revenue ratio above 15%.

— Revenue growth of over 20% to over $4B by 2030.

— EBITDAR margin target of 17-21%.

— Net debt-to-EBITDA ratio target of lower than 3.

— Cash balance to revenue ratio above 15%.

X

$ELAL / $ELAL.TA Conference Call Summary

— EpsilonTal (@epsilontal) March 13, 2025

HOLDING, NOT A RECOMMENDATION.

READ THE FULL ARTICLE ON BESTSTOCKS INFO.

ASK Growth and Market Demand

The increase in ASK (Available Seat Kilometers) significantly contributed to financial results.

The occupancy rate is the key story of… pic.twitter.com/HKJukb52e0